San Diego Home Insurance Fundamentals Explained

San Diego Home Insurance Fundamentals Explained

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Importance of Affordable Home Insurance

Safeguarding budget friendly home insurance policy is essential for protecting one's residential property and monetary well-being. Home insurance coverage supplies security versus numerous dangers such as fire, theft, all-natural catastrophes, and individual obligation. By having an extensive insurance strategy in position, homeowners can relax guaranteed that their most significant financial investment is secured in the event of unpredicted scenarios.

Affordable home insurance coverage not only offers financial safety but likewise offers satisfaction (San Diego Home Insurance). In the face of increasing building values and building and construction costs, having a cost-effective insurance plan makes certain that property owners can conveniently rebuild or repair their homes without encountering considerable economic burdens

Additionally, budget-friendly home insurance policy can also cover personal items within the home, providing compensation for things damaged or taken. This coverage extends past the physical framework of your home, shielding the contents that make a home a home.

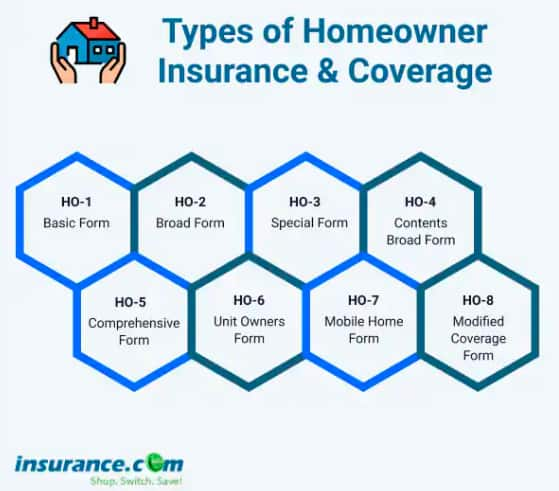

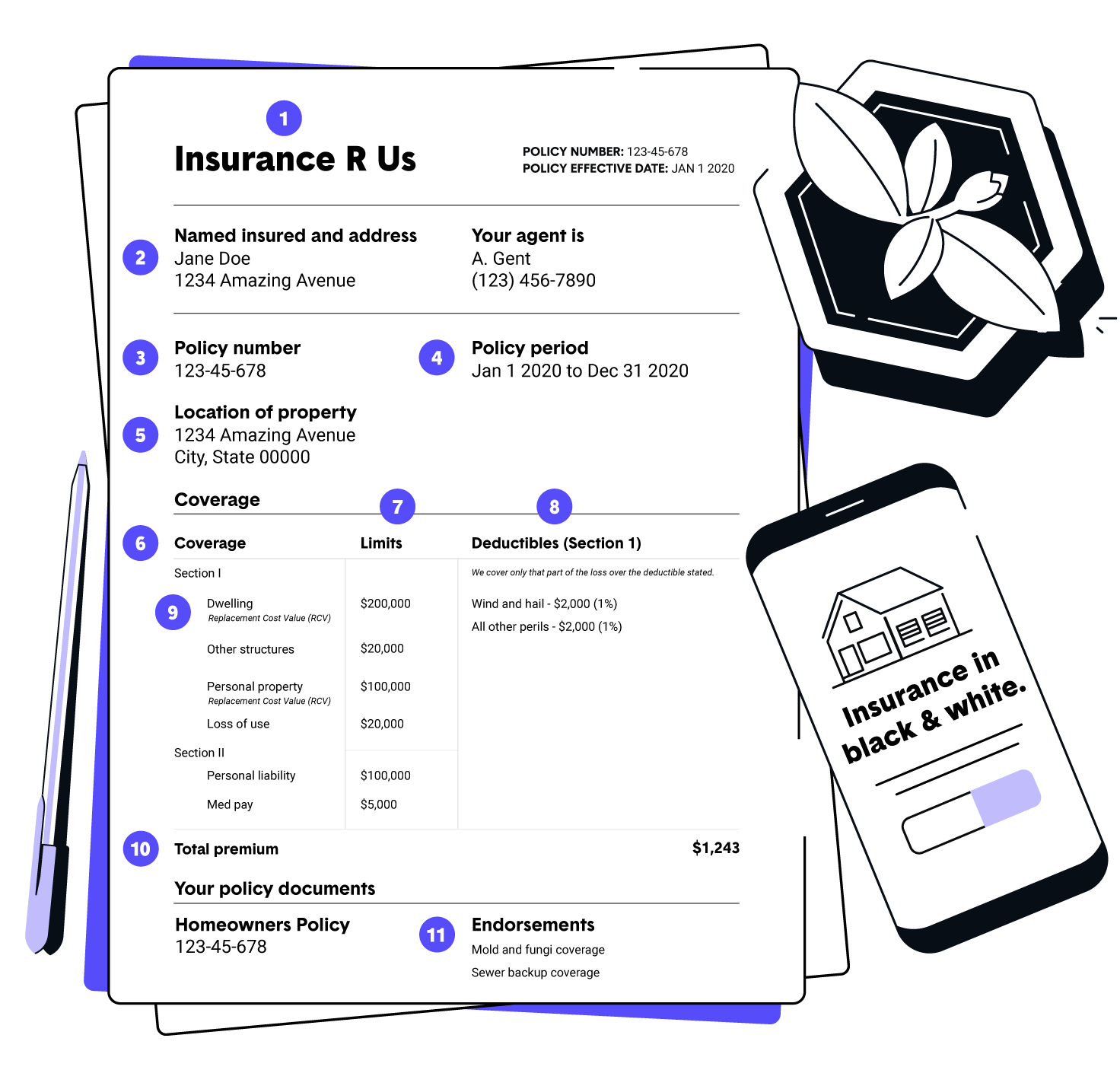

Insurance Coverage Options and Purviews

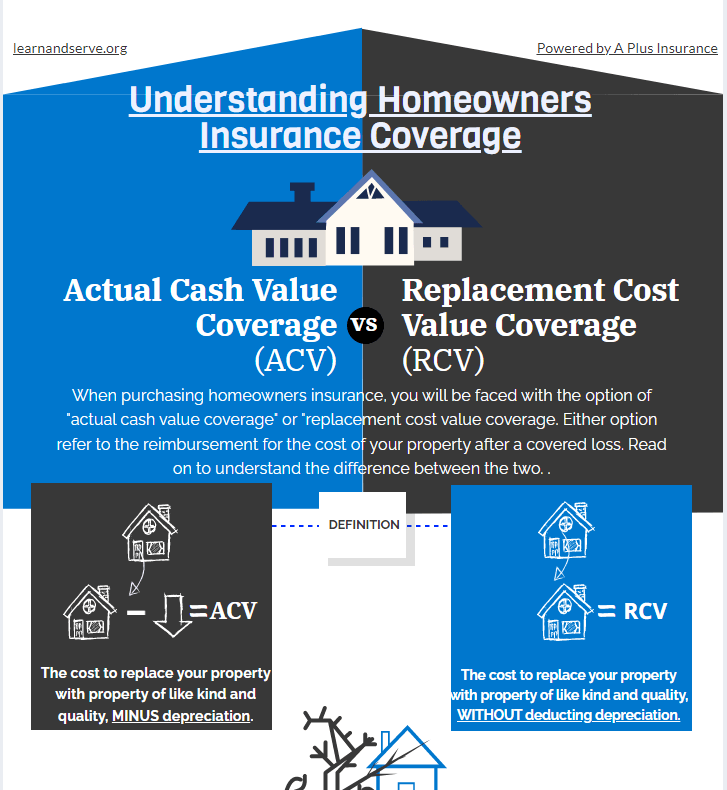

When it comes to coverage limitations, it's crucial to understand the maximum amount your policy will pay for each sort of insurance coverage. These restrictions can vary depending on the policy and insurance firm, so it's important to examine them meticulously to guarantee you have ample defense for your home and assets. By understanding the coverage choices and limitations of your home insurance coverage, you can make informed choices to guard your home and liked ones successfully.

Aspects Influencing Insurance Policy Prices

A number of variables substantially influence the costs of home insurance coverage. The place of your home plays a vital function in figuring out the insurance coverage costs. Residences in locations prone to natural disasters or with high crime rates normally have greater insurance prices as a result of enhanced threats. The age and problem of your home are likewise factors that insurers take into consideration. Older homes or residential or commercial properties in inadequate condition might be a lot more expensive to guarantee as they are much more at risk to damage.

In addition, the sort of insurance coverage you pick directly influences the cost of your insurance coverage. Going with additional insurance coverage choices such as flooding insurance or earthquake insurance coverage will raise your premium. In a similar way, choosing higher protection restrictions will certainly lead to greater costs. Your deductible amount can likewise impact your insurance expenses. A greater insurance deductible usually implies reduced costs, however you will certainly have to pay more out of pocket in the occasion of a case.

Additionally, your credit history, declares history, and the insurance coverage business you pick can all affect the cost of your home insurance coverage plan. By taking into consideration these elements, you can make educated decisions to help handle your insurance sets you back properly.

Contrasting Quotes and Service Providers

Along with contrasting quotes, it is critical to evaluate the reputation and financial stability of the insurance policy suppliers. Seek consumer testimonials, rankings from independent firms, and any kind of history of grievances or regulative actions. A reliable insurance service provider should go to this website have a good track document of without delay refining insurance claims and supplying outstanding customer solution.

In addition, think about the particular insurance coverage functions provided by each provider. Some insurance companies might offer added benefits such as identification theft defense, devices failure insurance coverage, or coverage for high-value things. By meticulously contrasting carriers and quotes, you can make a notified decision and choose the home insurance strategy that best satisfies your demands.

Tips for Minimizing Home Insurance

After completely contrasting quotes and companies to find the most appropriate coverage for your demands go to this site and budget, it is sensible to explore reliable methods for saving on home insurance coverage. Many insurance policy companies use discounts if you purchase numerous policies from them, such as combining your home and vehicle insurance coverage. Routinely assessing and updating your plan to mirror any type of adjustments in your home or situations can guarantee you are not paying for insurance coverage you no longer requirement, aiding you conserve cash on your home insurance coverage costs.

Verdict

In final thought, safeguarding your home and liked ones with inexpensive home insurance policy is crucial. Implementing suggestions for conserving on home insurance can also aid you protect the required security for your home without damaging the bank.

By unwinding the details of home insurance coverage plans and checking out useful strategies for protecting budget-friendly insurance coverage, you can make certain that your home and enjoyed ones are well-protected.

Home insurance coverage plans commonly use several insurance coverage choices to safeguard your home and possessions - San Diego Home Insurance. By understanding the coverage alternatives and limitations of your home insurance plan, you can make informed choices to protect your home and enjoyed ones their website effectively

Routinely assessing and updating your plan to reflect any kind of changes in your home or conditions can ensure you are not paying for protection you no longer need, assisting you conserve money on your home insurance policy premiums.

In verdict, safeguarding your home and liked ones with budget friendly home insurance coverage is crucial.

Report this page